Paxos is engaged in 'constructive discussions' with SEC: Report

Stablecoin issuer Paxos was reportedly discussing the Binance USD (BUSD) stablecoin with the United States Securities and Exchange Commission following a Wells notice from the financial regulator.

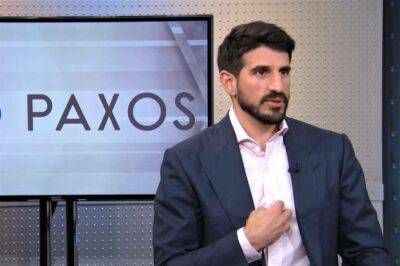

According to a Feb. 21 Reuters report, Paxos chief executive officer Charles Cascarilla said the firm was “engaged in constructive discussions” with the SEC and would continue to speak in private. The report followed the stablecoin issuer facing a lawsuit from the SEC, in which the regulator alleged BUSD was an unregistered security.

Cascarilla reportedly said that Paxos would consider defending its position that BUSD was not a security through litigation. On Feb. 13, the New York Department of Financial Services — Paxos is licensed in the U.S. state — ordered the company to stop the issuance of BUSD. The firm announced that it would halt minting of the stablecoin starting Feb. 21.

Paxos in discussions with U.S. SEC over Binance stablecoin- internal email https://t.co/3CS9UBPGV5 pic.twitter.com/LyxjCwU0bj

An SEC spokesperson previously told Cointelegraph that it would not comment on the “existence or nonexistence of a possible investigation” with Paxos, but the regulator’s move was the latest in a series of crypto enforcement actions. The SEC announced it had reached an agreement with Kraken on Feb. 9, in which the firm agreed to stop offering staking services or programs to U.S. clients and pay $30 million.

Related: SEC lawsuit against Paxos over BUSD baffles crypto community

The NYDFS investigation against Paxos may have stemmed from a report from Circle, which reportedly sent in a complaint to the state regulator regarding Binance’s reserves. Following the news around BUSD, data from Binance suggested there had been a surge of

Read more on cointelegraph.com

![Bitcoin [BTC] to slide under $20k soon? These metrics suggest…](https://finance-news.co/storage/thumbs_400/img/2023/3/18/60485_lcc.jpg)

![Could Bitcoin [BTC] be on course for another green weekend](https://finance-news.co/storage/thumbs_400/img/2023/3/18/60483_aut7a.jpg)