Polkadot: Estimating the probability of a pullback with tips for traders

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

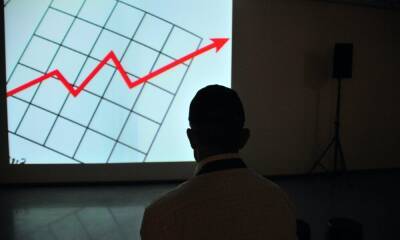

Polkadot formed a rising wedge pattern, which generally sees the price drop toward the base of the pattern. This was on lower timeframe price charts, which meant that a pullback could be a decent buying opportunity. On the other hand, this bearish pattern could be invalidated with a strong push upwards by the price.

Source: DOT/USDT on TradingView

The $19.41 resistance level loomed large on lower timeframes for DOT. Moreover, the price formed a rising wedge pattern (white). This is a bearish reversal pattern that can see the price pullback while on an uptrend.

Based on the move from $17.11 to $19.54, a set of Fibonacci retracement levels (pale yellow) was plotted. At the same time, the $17.5-$18 area has acted as a zone of both supply and demand for DOT in the past week. This demarcated the cyan box as an area where bulls could take a stand.

On the other hand, the rising wedge pattern can be invalidated if DOT manages to flip the $19.41 resistance to support, and breaks out to the north of the pattern.

Source: DOT/USDT on TradingView

The RSI on the hourly chart dropped toward neutral 50 even as the price attempted to push past the $19.41 level. This suggested waning bullish momentum even as the bulls tried to drive prices further higher. It was a similar story on the Awesome Oscillator.

Even though the AO remained above the zero line, it showed waning bullish momentum.

The OBV did not see a large drop yet and has been on an uptrend during the price’s formation of the wedge pattern.

The $18 area can be a place where DOT would drop to in the next day or two, and the $17-$18 area could be used to enter

Read more on ambcrypto.com

![Should Stacks [STX] traders expect more discounts in the days to come](https://finance-news.co/storage/thumbs_400/img/2022/4/28/23558_vyk9n.jpg)