Property tycoon Nick Candy locked in legal fight with former business partner

The property tycoon Nick Candy is locked in a bitter legal dispute with a former business partner in which they have traded allegations about each other’s conduct and financial worth.

The Tory donor’s firm Candy Ventures Sarl (CVS) is pursuing a claim for alleged fraudulent misrepresentation against the social media company Aaqua and its boss, Robert Bonnier. Bonnier was once seen as one of the City’s hottest young entrepreneurs as chief executive and founder of online business directory Scoot, which was valued at more than £2bn at the height of the dotcom boom but ended up being bought out for £5m.

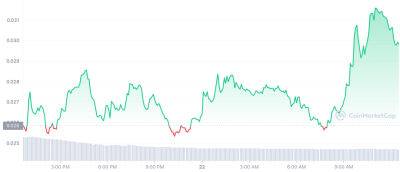

CVS is suing Bonnier, who was handed a then record fine in 2004 for misleading the stock market, claiming it was induced to invest in Aaqua on the basis of his representations that Apple and LVMH were also about to put their own money into the company. The deal involved CVS investing in Aaqua by transferring shares owned by Candy in Audioboom to Aaqua in return for shares issued by Aaqua in itself.

Candy, who is married to the former Neighbours actor Holly Valance, said he had reported Bonnier to the Financial Conduct Authority (FCA), the Serious Fraud Office (SFO) and the FBI over the allegations, which are denied by Bonnier. The Dutchman has brought a counter-restitution claim after sweeping freezing orders were wrongly granted against his and Aaqua’s assets.

So-called worldwide freezing orders, which apply not just in the UK but globally, were once described by a judge as “nuclear weapons of the law”. Aaqua and Bonnier claim the orders had a “catastrophic impact”, causing the loss of 160 jobs and €195m (£170m), which they are seeking to recover from Candy and his venture fund.

Lawyers for CVS have apologised for “misleading

Read more on theguardian.com