Researchers Say These 7 Factors Will Determine Bitcoin Prices in 2023

Researchers at the South Korean crypto exchange Bithumb have named seven factors they believe will affect bitcoin (BTC) and crypto prices in 2023 – and determine whether the bear market will give way to bullish forces for a sustained period.

The crypto exchange’s researchers claimed that bitcoin prices could rise to the $42,000 mark in the next 12 months – provided certain events come to pass.

Per Asia Today, the predictions were published in a report named 2023 Virtual Asset Market Outlook, published by the Bithumb Economic Research Institute.

The company graded each factor with a star rating out of four, with four stars denoting an event with maximum significance on the market. It also categorized the events as Bearish, Unknown, Neutral, or Bullish.

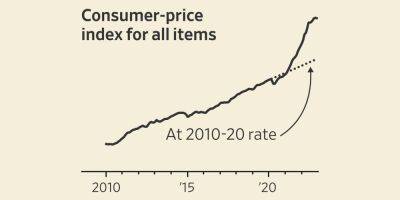

Bithumb identified potential two four-star bull events that could help spur BTC prices toward $42k. The first was the Federal Reserve’s forthcoming decision to ease “austerity measures.” The second was whether or not Russia will green-light its trading companies to use cryptoassets as a means of settlement in cross-border deals.

The Fed is widely expected to cut interest rates sometime this year – a move that many experts claim will encourage investment in crypto, and spark a prolonged recovery for major tokens.

Russia, meanwhile, has been frozen out of dollar-powered trading in most markets. But crypto-powered trade deals could provide an alternative for Moscow – despite some uncertainty from the nation’s crypto-skeptic Central Bank.

Two other events could have a significant impact on crypto prices, Bithumb researchers explained. These include a possible easing of crypto tax rates in Japan, which could spark an Asia-wide bull market.

Tokyo has indicated that it will review tax

Read more on cryptonews.com