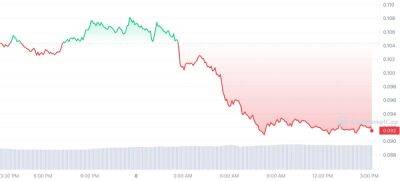

Ripple: Crypto lawyer explains the chinks in SEC’s allegations against XRP

Popular crypto lawyer Jeremy Hogan recently took to Twitter to offer his thoughts on the Securities and Exchange Commission’s controversial lawsuit against Ripple.

Hogan, who is a partner at Hogan & Hogan, paid particular attention to the arguments and allegations presented by the wall street regulator before the court.

In his Twitter thread, Jeremy Hogan pointed out that as per the legislative definition of security, the possible category that XRP may be designated is that of an investment contract.

The crypto lawyer was referring to the famous Howey Test, which the securities regulator has repeatedly cited in its case against Ripple. The test refers to a U.S. Supreme Court case that helps determine if a transaction qualifies as an investment contract and would therefore be considered a security and be subject to the country’s securities laws.

According to Hogan, the Howey Test doesn’t focus on the contract part of the investment contract but rather assumes that a contract existed and was required for an explicit legal agreement.

The crypto lawyer argued that in Ripple’s case, the SEC had failed to argue that there was an explicit contract of investment. Instead, the regulator has stated that the purchase agreement is all that is required.

Hogan believes that a simple purchase agreement only proves that Ripple had an obligation to transfer XRP to the buyer, with no mention of expected profits on the investment.

“The issue is NOT whether Ripple used money from the sale of XRP to fund its business. The issue is whether the SEC has proven that there was either an implied or explicit “contract” between Ripple and XRP purchasers relating to their “investment.” There was no such contract,” Jeremy Hogan stated.

Read more on ambcrypto.com