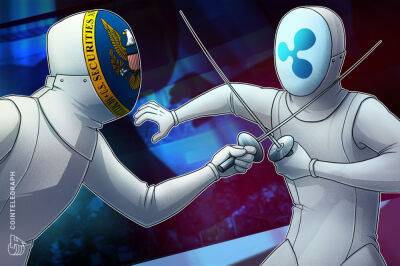

Ripple, SEC case heads for conclusion after 'summary judgment' filed

The U.S. Securities and Exchange Commission (SEC) and Ripple Labs have both called for a federal judge to make an immediate ruling on whether Ripple’s XRP sales violated U.S. securities laws.

In separate motions filed on Sept. 17 by Ripple and the SEC, both have called for summary judgment in the U.S. District Court Southern District of New York.

Summary judgments are submitted to the courts when a party involved believes there’s enough evidence at hand to make a ruling without the need to proceed to trial.

Both parties have called on Judge Analisa Torres to make an immediate ruling as to whether Ripple’s XRP sales violated U.S. securities laws. Ripple has argued that the SEC has run out of answers to prove XRP sales constituted an “investment contract," while the SEC has held strong on its beliefs that it does.

Ripple CEO Brad Garlinghouse in a Twitter post on Sept. 17 said the filings made it clear that the SEC “isn’t interested in applying the law.”

“They want to remake it all in an impermissible effort to expand their jurisdiction far beyond the authority granted to them by Congress,” he said.

Today's filings make it clear the SEC isn’t interested in applying the law. They want to remake it all in an impermissible effort to expand their jurisdiction far beyond the authority granted to them by Congress. https://t.co/ooPPle3QjI

Meanwhile, Ripple general counsel Stuart Alderoty noted that “after two years of litigation” the SEC is “unable to identify any contract for investment” and “cannot satisfy a single prong of the Supreme Court Howey test.”

In its motion for summary judgment, Ripple claimed that the SEC’s case “boils down to an impermissibly open-ended assertion of jurisdiction over any transfer of an asset."

The motion

Read more on cointelegraph.com