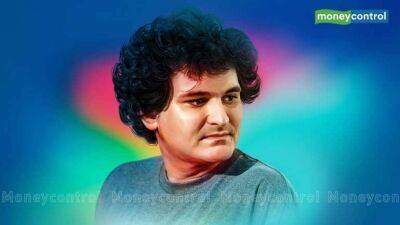

Sam Bankman-Fried: What's Next In Crypto Exchange FTX's Bankruptcy

Customers who withdrew their assets from FTX before its collapse are not necessarily in the clear.

Crypto exchange FTX filed for Chapter 11 bankruptcy protection in the United States on Friday following its precipitous collapse, saying it could owe money to more than 1 million creditors. Here is what likely awaits in the case:

WHERE DO THINGS STAND IN FTX'S BANKRUPTCY CASE?

FTX had an unusually slow start to its bankruptcy, taking nearly a week to file "first-day" papers that describe the company's debts and how it ended up in bankruptcy.

The reason for that delay became apparent when FTX's new CEO, John Ray, described the "unprecedented" chaos at the company in court filings on Nov. 17.

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here," said John Ray, a restructuring expert with decades of experience who oversaw the multiyear liquidation of energy firm Enron after its collapse in 2001.

John Ray, who took over as CEO when FTX filed for bankruptcy protection, said his immediate priorities are locating and securing assets, investigating claims against insiders like former FTX CEO Sam Bankman-Fried, and cooperating with dozens of regulatory investigations in the United States and abroad.

The dire situation at FTX will make it difficult for the company to borrow new money that could be used to reorganize the company or buy time for a sale, according to University of Pennsylvania law professor David Skeel.

HAS FTX BEEN ABLE TO SECURE CUSTOMER ASSETS?

Sam Bankman-Fried secretly used $10 billion in customer funds to prop up his trading company Alameda Research, and at least $1 billion of those deposits have vanished, sources

Read more on ndtv.com

ndtv.com

ndtv.com