SEC Commissioner Mark Uyeda Calls for Regulatory Rules on Crypto

The US Securities and Exchange Commission (SEC) has tried regulating the crypto space through enforcement actions in the last three years.

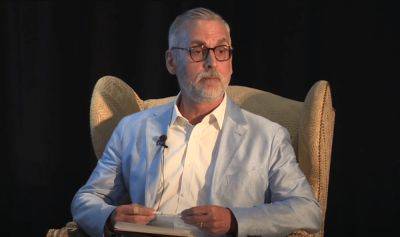

In the opinion of the agency’s commissioner, Mark Uyeda, this shortsighted approach makes it harder to bring much-needed clarity to the nascent industry.

During the Friestad Memorial Lecture in London, Uyeda expressed his opinions.

The SEC commissioner suggested that the agency should have established clear guidelines regarding acceptable and unacceptable behavior in the cryptocurrency industry. This would have given investors the necessary clarity to navigate the emerging industry.

In contrast, the SEC, led by former blockchain professor Gary Gensler, has taken an enforcement approach, which Uyeda sees as a deviation from the expected norm of operation.

“Unfortunately, the SEC did not take this approach and instead is pursuing a case-by-case approach through enforcement actions. As a result, it will take years to reach any type of legally binding precedent, as matters will need to wind their way through the courts before reaching the courts of appeal level,” Uyeda added.

The Republican commissioner, who joined the SEC in 2006, stated that the agency has intentionally side-stepped the chance to propose rules for the crypto space despite a slew of directives the agency gave in the past two years.

To him, the SEC’s slew of enforcement actions as a regulatory policy shows that it is not keen on providing a chance for the public to make an input.

Gensler-led SEC has been fixated on the idea that all cryptocurrencies (bar Bitcoin and Ethereum) are securities.

According to a June 8 post, the SEC listed 67 top crypto brands as asset securities. In the list were Solana, Binance Coin (BNB),

Read more on cryptonews.com