Solana Price is Up 87% in a Month - Buy Before Recovery Takes the Price Past $30 Soon?

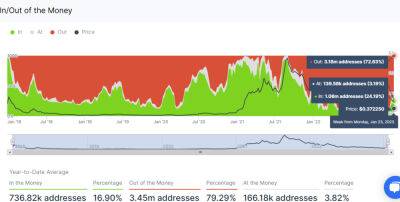

The Solana price explosive move since late December has seen investors rush back to the project in the wake of the FTX implosion. Recovery began with a final dip to $8.05, riding on the momentum created by BONK, the first meme token on the Solana blockchain.

Demand for SOL increased exponentially with the meme coin hype, leaving a positive ripple effect on Solana price, which has rallied 87% in just 30 days. However, the smart contracts token paused the uptrend at $24.00, with bulls seeking refuge above $20.00 since Friday.

Solana price has been holding above $20.00 for five days now, as bulls plan the next breakout to $30.00 and $40.00, respectively. While voluminous trading volumes backed the explosive price action, the Money Flow Index (MFI) shows that more money is leaving Solana markets than the funds flowing in.

The MFI is a momentum indicator like the Relative Strength Index (RSI), but it utilizes volume rather than price. From the 12-hour timeframe chart, we see the MFI sliding below the sharply rising trend line. This shows overhead pressure could push down Solana price, leading to a retracement below $20.00, unless bulls push for the resumption of the uptrend as soon as possible.

Therefore, buyers who may have been sidelined by the rally to $24.00 may want to consider making a comeback to provide Solana price with enough momentum to push above that resistance.

The Moving Average Convergence Divergence (MACD) indicator is much closer to confirming a sell signal in the same time frame. Notice the MACD (line in blue) crossing below the signal line (in red). Furthermore, declines may intensify as the MACD drops to the mean line, and possibly into the negative region.

Solana price sits on top of robust support between

Read more on cryptonews.com