Squid 2.0 Coin Is The Top Trending Crypto on DEXTools - Another Scam or Legit?

The recent trend of 2.0 meme coins now even includes an homage to the infamous Squid Game (SQUID) crypto scam, which rugpulled investors in 2021 - is Squid2.0 also a scam?

For traders not around during the last crypto bull run, the Squid Game token claimed to be a play to earn cryptocurrency inspired by the South Korean Netflix series of the same name.

Launched on decentralized exchanges in late 2021 - shortly before Bitcoin and Ethereum hit their all-time highs - $SQUID crashed over 99.99%, with holders unable to sell their tokens.

'Squid's developers have made off with an estimated $3.38m (£2.48m), according to technology website Gizmodo.' - BBC , Nov 2, 2021

While rug pull scams are common - seen on an almost daily basis on DEX platforms like PancakeSwap and Uniswap - Squid coin was one of the most successful for the scammers, taking place at the height of retail interest in cryptocurrency.

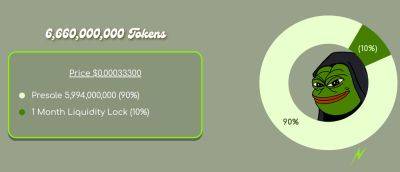

The Squid market cap at its peak was over $2.1 trillion, more than double the total crypto market cap - an important lesson in how market capitalization figures are just theoretical, calculated by multiplying the latest token price by the supply of coins that exists.

If an asset is illiquid, with thin order books, and holders are unable to take profit, its market cap doesn't represent real demand and can be 'rugpulled' from a high valuation to zero instantly. Especially if more tokens can be minted, or some wallet addresses are blacklisted from trading by the developers - commonly seen with scam tokens.

As the Squid token's CoinMarketCap page writes, the project achieved a meme coin like status, being 'now ostensibly run by community after the initial rugging' - the above video clip is widely shared across crypto Twitter to this day.

Read more on cryptonews.com