Tax implications on capital gains earned by NRIs

Taxability depends on the residential status of the individual. For instance, a resident taxpayer has to pay tax on his global income; however, a non-resident Indian (NRI) is liable to income tax only on the income earned from Indian sources.

NRIs can invest in equity stocks and mutual funds, provided they abide by the Foreign Exchange Management Act (FEMA) provisions.

The capital gains tax provisions for NRIs are similar to those for the resident individuals except for the applicability of TDS provisions. Like resident investors, the taxability of capital gains also depends on the holding period and the type of investments sold.

Types of investments and their tax implications;

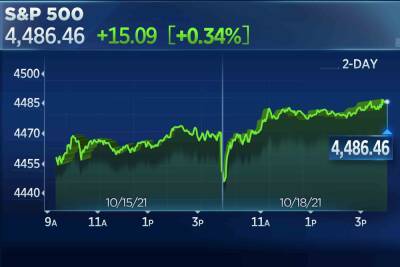

Capital gain on equity and related instruments by NRI For listed

Read more on financialexpress.com