Taylor Swift Avoided FTX Lawsuit by Asking One Simple Question

Pop superstar Taylor Swift was almost among the 11 celebrities now wrapped up in a costly class action lawsuit against Sam Bankman-Fried’s FTX—but asking a simple question saved her.

Earlier this week, Adam Moskowitz, one of the lawyers leading the class action lawsuit against FTX’s celebrity ambassadors, told The Scoop podcast that Swift was “the one person” that asked whether the securities she would be promoting are unregistered.

“In our discovery, Taylor Swift actually asked that. ‘Can you tell me that these are not unregistered securities?’” Moskowitz told The Scoop when asked why the celebrities alleged in the lawsuit did not check with their lawyers before signing these types of contracts. Moskowitz said that under state securities laws, promoting unregistered securities for financial gain makes an individual liable.

According to the Financial Times, the now-bankruptFTX was in talks with Swift for a $100 million sponsorship deal, which fizzled out shortly before FTX’s collapse in November of last year.

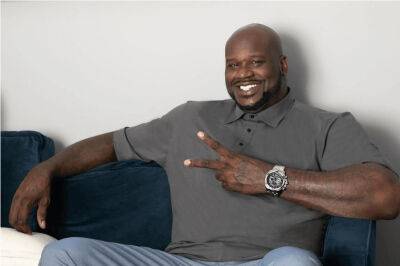

Swift’s due diligence saved her from a costly mistake. Moskowitz told The Scoop that they are seeking $5 billion in damages in the FTX lawsuit from celebrities who promoted the sale of unregistered securities. There are 11 celebrities—and one basketball team—named in the lawsuit, including Tom Brady, Seinfeld creator Larry David, and Shaquille O’Neal. “If they had just asked that question,” said Moskowitz, referring to the celebrities now involved in the lawsuit.

Moskowitz said that those who joined FTX are automatically registered for interest accounts that the Securities and Exchange Commission (SEC) has ruled are securities. “It’s money you’re lending them, and you’re going to get a return based on the

Read more on investopedia.com

investopedia.com

investopedia.com