Terraform Labs contends Citadel Securities had a hand in its stablecoin collapse

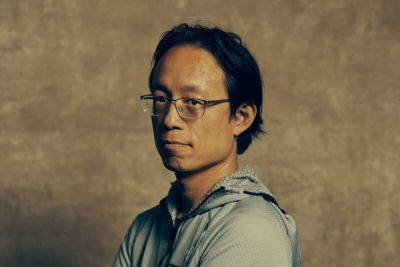

Do Kwon-founded Terraform Labs has again pointed the finger at market maker Citadel Securities for its role in an alleged “concerted, intentional effort” to cause the depeg of its TerraUSD (UST) stablecoin in 2022.

On Oct. 10, Terraform Labs filed a motion in the United States District Court in the Southern District of Florida to compel Citadel Securities to produce documents relating to its trading actions in May 2022, around the time its stablecoin, now known as TerraUSD Classic (USTC), depegged.

It contends the May 2022 depeg — when the asset crashed from $1 to $0.02 — was caused by “certain third-party market participants” intentionally shorting the stablecoin instead of instability in its algorithm.

“Movant [Terraform] contends that the market destabilization that occurred did not result from instability in the algorithm underlying the UST stablecoin,” said the firm in its motion.

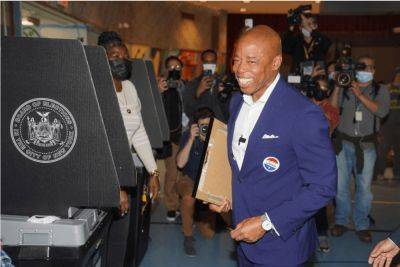

The motion also cites “publicly available evidence” suggesting that Citadel head Ken Griffin intended to short the stablecoin around the time of the depeg.

The filing cited a screenshot from a Discord channel chat in which a pseudonymous trader had lunch with Griffin, who allegedly said, “They were going to Soros the f*** out of Luna UST,” presumably in reference to George Soros’ trading strategies centered around highly leveraged, one-way bets.

Citadel Securities has, however, previously denied trading the TerraUSD stablecoin in May 2022, according to Forbes.

Cointelegraph contacted Citadel for additional comment but did not receive an immediate response.

Related: Do Kwon says SEC’s extradition request is impossible

In its motion, Terraform argues that the documents are crucial for its defense in the lawsuit filed by the U.S.

Read more on cointelegraph.com