The A to Z of the landmark crypto bill and the community’s reactions to it

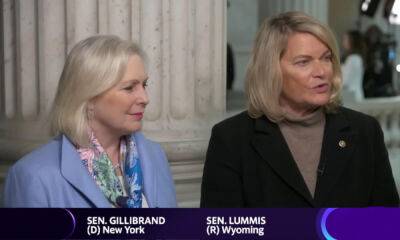

Senators Cynthia Lummis and Kirsten Gillibrand proposed the Responsible Financial Innovation Act on 7 June. This is the first attempt to build a comprehensive regulatory framework regarding digital assets in the United States.

The bipartisan effort of Lummis and Gillibrand is regarded as a landmark bill as it attempts to integrate digital assets into the financial system. The Bill attempts to “Spur innovation, develop clear standards, define appropriate jurisdictional boundaries and protect consumers”, as per Sen. Gillibrand.

The legislation, “encourages responsible financial innovation, flexibility, transparency, and robust consumer protections while integrating digital assets into existing law,” as per the press release.

The bill comes after massive growth in the digital asset industry over recent years. However, there is increasing regulatory ambiguity in the sector because of a lack of appropriate legislation.

Furthermore, the bill created a clear standard for determining which digital assets are commodities and what types are securities. According to the press release,

“The Bill also authorizes a special depository institution charter under both state law and the National Bank Act for payment stablecoin issuance, with tailored capital requirements and holding company supervision.”

It also proposes the development of a Self-Regulatory Organisation (SRO) for maintaining strong supervision within the industry. Lummis added that the bill “creates regulatory clarity for agencies charged with supervising digital asset markets, provides a strong, tailored regulatory framework for stablecoins, and integrates digital assets into our existing tax and banking laws.”

Many experts in the crypto industry believe this is a welcoming

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com

![Ethereum [ETH] miners’ revenue check amid ‘Merge’ anticipation](https://finance-news.co/storage/thumbs_400/img/2022/7/5/32234_uofik.jpg)