The last Bitcoin: What will happen once all BTC are mined?

Satoshi Nakamoto mined the genesis block on Jan. 3, 2009, minting the first 50 Bitcoin (BTC) in history and kicking off what would become a billion-dollar industry centered around mining crypto. However, with a cap on Bitcoin supply, the fate of miners after the last coins are issued is unclear.

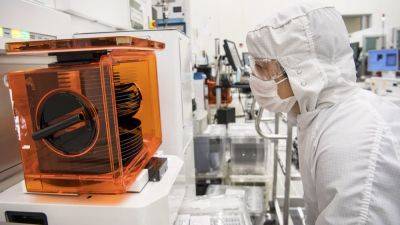

Bitcoin is created through mining, a process involving computer hardware to solve complex mathematical problems and verify transactions on the blockchain network. For their efforts, miners are rewarded with a predetermined amount of BTC for each block of transactions.

According to the Blockchain Council, more than 19 million BTC has been awarded to miners in block rewards, and according to Nakamoto’s white paper, only 21 million are available. Once this cap is reached, miners will no longer receive rewards for verifying transactions.

Speaking to Cointelegraph, Nick Hansen, founder and CEO of Bitcoin mining firm Luxor Mining, says that despite the loss of block rewards, miners will continue to play an essential role in verifying and recording transactions on the blockchain, but how they are compensated will evolve.

Currently, successfully validating a new block on the blockchain rewards miners with 6.25 BTC, worth about $188,381 at the time of writing, according to CoinGecko. Miners also receive transaction fees.

According to calculations shared in a May 1 tweet from on-chain analytics firm Glassnode, since 2010, fees and block rewards have netted miners over $50 billion.

Since #Bitcoin's inception, Miners have earnt a total revenue of $50.2B from the block subsidy and fees, for an all-time estimated input cost of $36.6B.This places the all-time-aggregate profit margin for Miners at $13.6B (+37%). pic.twitter.com/TYvBSZbsRo

Hansen

Read more on cointelegraph.com