These Bitcoin observations suggest that a range change might be…

Bitcoin [BTC] is back above $20,000 once again but this time there is a notable lack of enthusiasm about it. This is because the cryptocurrency had been bouncing back and forth between the $17,000 to $22,000 range.

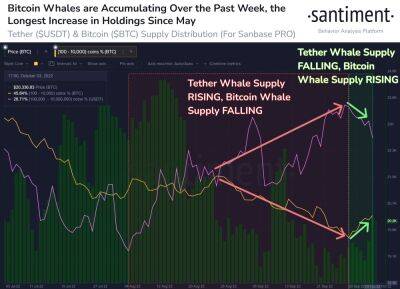

The king coin has been shuffling within the same range for the last few weeks. BTC whales played a significant role in enabling the range by buying near the range bottom and selling near the range top.

However, there are some recent observations that strengthen the argument for a potential short-term breakout despite a previously gloomy outlook.

A comparison between the Bitcoin exchange whale ratio and BTC’s exchange reserves revealed an interesting picture. The latter had been declining since March while the former was gradually ascending.

Source: CryptoQuant

The exchange whale ratio particularly achieved higher lows since May. This confirmed that whale activity on exchanges witnessed a rise.

Such an outcome confirmed that larger amounts of BTC were being traded, thus paving the way for more volatile price changes.

The declining exchange reserves confirmed that Bitcoin had been flowing out of exchanges in the last few months. Investors’ sentiment also appeared to have shifted in favor over the last few days, especially in the derivatives market. This was evident considering the rise in open interest and funding rates in the derivatives market.

Source: CryptoQuant

Both open interest and funding rates in the derivatives market have increased significantly in the last two weeks. The current open interest levels were notably higher than they were on 12 September, which was the peak of the previous bullish attempt.

These observations were also consistent with the observed increased demand for BTC by whales and institutions.

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com

![Brazil: USDT, Bitcoin [BTC], and…? New crypto-declarations suggest…](https://finance-news.co/storage/thumbs_400/img/2022/10/10/44336_y5v.jpg)

![This Bitcoin [BTC] metric is high and whales may have something to do with it](https://finance-news.co/storage/thumbs_400/img/2022/10/10/44306_fruul.jpg)

![Ethereum Classic [ETC] crashes past $27.3, but traders might need to be cautious](https://finance-news.co/storage/thumbs_400/img/2022/10/9/44193_mdgz.jpg)