THG shares surge on takeover move amid spate of US private equity offers for UK firms

The share price of online retail tech company THG has surged after it received a takeover approach from US investor Apollo, amid a spate of attempted private equity takeovers of mid-sized British companies.

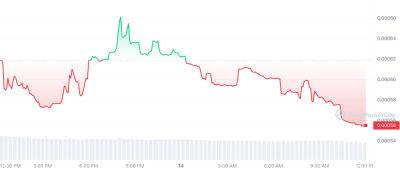

THG’s share price jumped by 34% on Monday morning to 88p, having reached 97p in earlier trading after it revealed the approach in a statement to the stock market. It was valued at £860m on Friday before the offer was revealed.

The online shopping group, which was formerly known as The Hut Group and whose largest shareholder is founder Matthew Moulding, gave no details about the offer, other than saying it was a “highly preliminary and non-binding indicative proposal”, and that there was no guarantee a firm offer would be made.

The approach was the latest in a series of bids for British companies by foreign private equity firms, with Britain seen as “ripe for takeovers”, according to one analyst.

Oilfield services group John Wood Group jumped after it said it was also open to takeover talks with Apollo, while Middle East and Africa payments company Network International said it would probably recommend an offer by CVC and Francisco Partners, two more US private equity firms.

They are not the only recent targets for foreign takeovers. Drug company Dechra Pharmaceuticals was targeted by Swedish private equity firm EQT last week, the property investment company Industrials REIT on Friday agreed to a takeover by US investor Blackstone, and events company Hyve Group last month agreed a deal with US firm Providence Equity Partners.

British investors have been concerned for several years that UK companies are vulnerable to takeover by foreign firms because of a weakening exchange rate. The pound was worth more than $1.45 in June

Read more on theguardian.com