This Is Why Crypto Prices Are Benefiting From Dollar Index Weakness That Could Continue All Year

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com

For the past few months, cryptocurrency prices have relatively gone in the inverse direction to the U.S. dollar. And as inflation begins to ease, the U.S. Dollar Index (DXY) has also seen losses. Here’s why coin prices are benefiting from this reversal and what investors might expect.

At press time, the U.S. Dollar Index currently stands at 102.31. The Index is experiencing a downtrend of 0.23% in the past 24 hours, further continuing the greenback’s slide against other major currencies. Already, the Japanese yen is looking especially attractive to investors, with the currency hitting a seven-month high against the greenback.

The drop in the dollar value is coming as investors’ risk appetite starts to grow once more. All through 2022, inflation was the biggest issue in the United States as the Federal Reserve looked to quell monetary supply following stimulus spending amid the coronavirus pandemic.

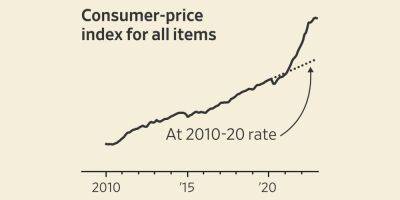

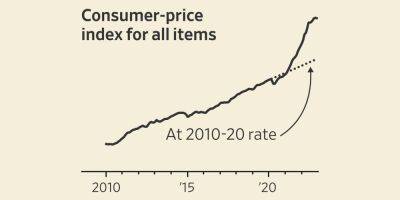

To control inflation, the Fed embarked on several interest rate hikes to remove money from circulation and prevent everyday citizens from spending too much. While it was a long and arduous journey, this policy started to yield results towards the home stretch of 2022. By December, the government had reported a Consumer Price Index (CPI) drop of 0.1% for the month. This brought inflation back to 6.5%, down from 7.1% a month earlier.

Many investors are encouraged by the drop in inflation because they believe the Federal Reserve will be more willing to ease its tightened monetary policy and provide a more welcoming environment for them to borrow money and access capital. This has led to

Read more on cryptonews.com