Top 3 Price Predictions: Bitcoin, Ethereum, and eTukTuk Forecasts for 2023

Disclaimer: The text below is a press release that is not part of Cryptonews.com editorial content.

Bitcoin and Ethereum continue to dominate the market uncontested. But their performance over the last few months has been lackluster. Do they have what it takes to give generous returns to investors this year?

Or, is it time for investors to start looking for emerging alternatives like eTukTuk for that 10X price surge? Here is an analysis.

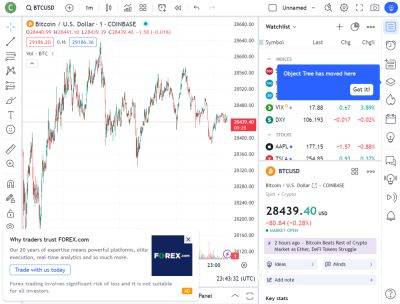

The Bitcoin price has been hovering below $30,000 over the past couple of months. But long-term investors are optimistic that a potential price reversal is just around the corner.

They’re not completely wrong. Bitcoin appears to be slowly regaining its footing, and the Bitcoin halving event scheduled for April 2024 is likely to play a key role in shaping its price trajectory.

According to analysts, Bitcoin could climb to as high as $100,000 in the weeks leading up to this event. Investors are expanding their BTC portfolio and cherishing this dream.

But such a rapid ascent to $100,000 is unrealistic. If BTC were to hit $100,000 by April 2024, it should have begun the climb long back. That has led a substantial portion of analysts to predict a more conservative target of $50,000 for BTC.

There are also less popular opinions that BTC could experience a significant dip, potentially to as low as $20,000, ahead of the halving event. High-cap assets like BTC are losing their grip among young investors who have faced losses since 2021.

BTC’s price trajectory in the coming months will be crucial to its journey ahead. If it fails to cross the $40,000 mark by the year's end, a cascade of sell-offs may follow.

ETH has to be one of the most disappointing cryptocurrencies of 2023. Despite the growth of

Read more on cryptonews.com