UK economy forecast to shrink this year, says IMF

The UK economy is expected to shrink this year and will be at the back of the leading G7 countries at a time when a fresh outbreak of financial upheaval threatens the slowing global recovery, the International Monetary Fund has warned.

Stressing the growing risks of a hard landing for developed countries, the Washington-based body singled out the UK and the euro area as being particularly affected by rising energy costs and higher inflation.

The IMF slightly revised up its estimate of UK growth this year from the -0.6% pencilled in three months ago but still expected the economy to contract by 0.3%.

After being the fastest-growing economy in 2022, the UK – along with Germany – is one of only two G7 countries predicted to contract in 2023, according to the IMF’s world economic outlook (WEO).

Its economic counsellor, Pierre-Olivier Gourinchas, said there would be no early respite from the UK’s cost of living crisis, which has taken theannual inflation rate to 10.4%, and only a modest bounceback to 1% growth next year, when the general election is scheduled to be held.

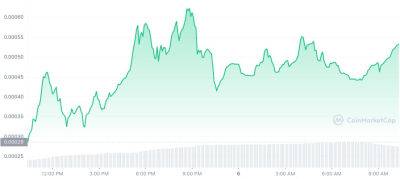

“We do continue to predict a recession in 2023 on the back of the fairly sharp impact of rising energy prices, monetary policy tightening and some tightening of financial conditions,” Gourinchas said. “Our overall assessment is that this is going to be a challenging year for the UK but growth is going to increase in 2024.”The IMF said it expected global growth to slow from 3.4% in 2022 to 2.8% this year – with the risks of an even sharper easing if last month’s problems affecting regional US banks such as the collapsed Silicon Valley Bank and Switzerland’s recently rescued Credit Suisse prove to be symptomatic of a more widespread malaise.

The WEO said the slowdown

Read more on theguardian.com