US regulator seeks feedback on DeFi’s impact on financial crime: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

The United States regulators want to take a closer look at money laundering and terror financing laws by the Financial Crimes Enforcement Network (FinCEN), as it asked banking sector players for feedback on DeFi’s crime risks.

Ethereum developers are targeting the last week of March for Ethereum’s Shanghai hard fork and some additional improvement upgrades by June of next year. Ankr protocol has deployed $15 million to buy back the bad debt resulting from its recent exploit and the resultant circulation of HAY (HAY).

Chainlink deploys staking to increase the security of oracle services. Stakers will earn Chainlink (LINK) tokens as they participate in a decentralized alerting system that flags the network when feeds are not meeting performing requirements.

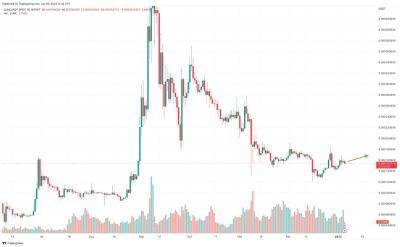

The top 100 DeFi tokens had a mixed week in terms of price action, as many tokens traded in green while several others posted a net loss on the weekly charts.

A United States financial regulator is looking to gain feedback from the banking industry about how DeFi may affect the bureau’s efforts to stop financial crime.

The FinCEN said it is “looking carefully” at DeFi, while the agency’s acting director, Himamauli Das, said the digital asset ecosystem and digital currencies are a “key priority area” for the agency.

Continue reading

According to a discussion at the 151st Ethereum Core Developers Meeting on Dec. 8, core programmers have set a tentative deadline of March 2023 for Ethereum’s Shanghai hard fork. In addition, developers will aim for May or June 2023 to launch the Ethereum Improvement

Read more on cointelegraph.com