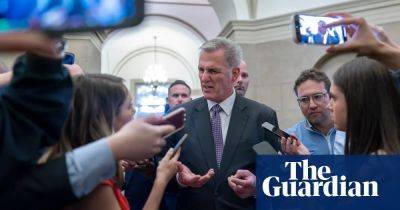

Vauxhall owner probably isn’t blameless, but UK needs to switch on to the car crisis

H as Stellantis, the owner of Vauxhall, sounded the death knell for the (already shrunken) volume end of the UK car industry? Does the group’s warning that it could shut its UK operations unless post-Brexit trading rules are renegotiated represent an existential threat to the sector, as some voices immediately declared?

Well, it obviously isn’t possible to put a positive spin on Stellantis’s submission to the business select committee. It is less than two years since the company, which also produces Peugeot, Citroën and Fiat vehicles, announced a £100m investment in light electric vans in Ellesmere Port, complete with government backing.

So the threat is to perform an almighty U-turn, which, unfortunately, could be credible from a practical perspective. The group has alternative places to produce electric vans, notably a plant in Portugal that is being expanded.

Yet there are three points of context to make here – and two suggest warnings of wider Armageddon may be slightly premature. First, while the “rules of origin” requirements, which dictate the content by value of a vehicle that must be sourced in the UK or EU, are a headache for all big carmakers during the electric transition, not everybody is issuing threats as loudly as Stellantis.

The Tata-owned Jaguar Land Rover said as recently as last week that its UK factories were safe even if it chose to source electric car batteries from Spain. Up in Sunderland, Nissan has a dedicated battery supplier – the Chinese group Envision – next door, so it should have no difficulty in meeting the 45% by 2024 demand.

Toyota’s electric plans for the UK are mysterious, but one has to ask if the deep problem for Stellantis, which knew about the 2024 deadline when it made its 2021

Read more on theguardian.com