Venezuela’s Digital Currency Use to Face Tighter Regulatory Scrutiny

Experts warn that Venezuela’s likely shift towards digital currency necessitates stricter regulations.

The development comes as Venezuela’s state oil company PDVSA is ramping up digital currency use for crude oil and fuel exports, according to Reuters. This decision follows the Biden administration declining to renew a license that had eased restrictions. Essentially, this led to reimposed sanctions on Venezuela’s oil industry.

In response, Venezuelan opposition politician Leopoldo Lopez and a Chainalysis director Kristofer Doucette presented a report on Monday, calling for democratic governments to take action. Their report detailed financial transactions conducted since Venezuelan President Nicolas Maduro’s inauguration.

Government efforts should be taken to counter “Maduro’s attempts to exploit cryptocurrency to move illicit proceeds into the international financial system,” the report said.

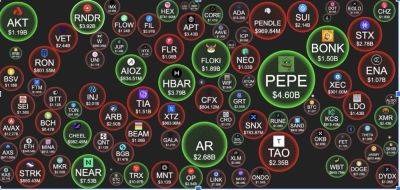

Since last year, PDVSA has reportedly been quietly ramping up its use of digital currency. The company has particularly been using Tether (USDT) for oil sales to avoid having accounts frozen by US oil sanctions.

Maduro earlier suggested there are countries interested in doing business with Venezuela. But they would be willing to do so if they could use digital currency to avoid the traditional financial system.

The report further stated that other autocratic leaders under international sanctions, like those in Iran and Russia, have launched their own crypto programs. These programs, the report alleges, are a way to dodge financial systems reliant on US dollars or Euros, currencies vulnerable to sanctions.

Lopez and Doucette put out a strong call to action for Western governments, particularly the US. To safeguard sanctions’