Venture capital's ICO gambits left Bitcoin ecosystem underfunded - Adam Back

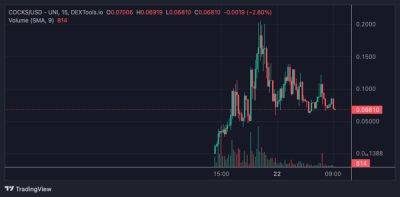

Initial coin offerings (ICOs) may have hampered the development of the Bitcoin ecosystem, with market research reflecting a massive slant towards non-Bitcoin investments by venture capitalists over the past five years.

Blockstream CEO Adam Back highlighted the juxtaposition between the lack of venture investment in Bitcoin in comparison to its dominance of the total cryptocurrency market capitalization in conversation with Cointelegraph’s Joseph Hall at the Lugano Plan B Summer School in Lugano, Switzerland.

Back, the inventor of Hashcash upon which Bitcoin’s proof-of-work algorithm was derived, pointed to market research published by Trammell Venture Partners which detailed venture capital flows into the ICO craze in the years following the launch of Ethereum and smart contract functionality.

Back said that venture capital spending on ICOs has wound down in recent years after an initial surge in attraction to ‘early liquidity:

Back added that ICOs had made investors a lot of money, but the phenomenon did not necessarily result in products that people can use and value getting to market because ‘incentives are misaligned’.

Related: What is Bitcoin, and how does it work?

Trammell Ventures’ report surveyed market data which reflects that 97% of venture capital investments over the past few years flowed into ‘crypto’ and not Bitcoin. Back highlighted ICOs, altcoins, discounted tokens and other projects all attracting investors:

Back said that while the Bitcoin space is being underfunded by this category of investors, builders within the ecosystem "produce more innovation and more product value" when compared to ‘crypto’ ICOs that have attracted the lions’ share of VC spending.

The failure of FTX and implosion of decentralized

Read more on cointelegraph.com