What AAVE’s 12% surge can mean to investors after Harmony’s $100M exploit

The second biggest DeFi protocol in the world, AAVE took a massive hit over the last three months after the total value locked on the lending dApp fell from $14 billion to $5.03 billion. That’s not all. AAVE was also affected during the recent Harmony hack, which resulted in a $100 million exploit. Considering the altcoin’s tough road, it can be stated that…

The Ethereum-Harmony bridge that was exploited also affected AAVE V3 Harmony. The protocol was disrupted as the assets exploited were also listed on the protocol, specifically DAI, USDC, USDT, and AAVE.

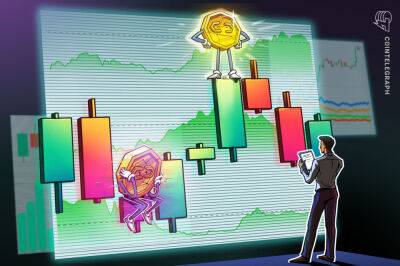

However, since V3 was not the primary target of the attack, it did not endure any losses. The only losses it has faced have been the result of the broader market’s bearishness which caused a 21% decline in its value. However, the asset rallied by 12.7% in the last 24 hours, igniting optimism among its investors.

But it isn’t certain if the rally triggers a recovery in the case of the altcoin, it will still need a lot more than a green bar. Trading at $63.07, AAVE can still possibly climb the charts since the token has the support of its investors, which is becoming relatively rare these days.

Source: TradingView

On an average, AAVE investors have been conducting transactions amounting to more than $40 million, with the same peaking at $127 million towards the end of June.

This is despite the fact that more than 89.5% of AAVE holders have been facing losses for more than a year now. The last time all AAVE investors were in profit was back in January 2021.

AAVE correlation to Bitcoin | Source: Intotheblock – AMBCrypto

This also began affecting the average balance on each investor’s wallet since the rest of the market continued to remain stuck in a downtrend, and at the same

Read more on ambcrypto.com