Will Radiant Capital’s RDNT enjoy a bullish course? Binance has an answer

On 30 March, Binance [BNB], the largest crypto exchange in the world, announced the listing of RDNT. The latter is the native token for an upcoming multi-chain DeFi platform Radiant Capital.

<p lang=«en» dir=«ltr» xml:lang=«en»>Binance announced the 32st project on Binance Launchpool – Radiant Capital (RDNT). Users will be able to stake their BNB and TUSD into separate pools to farm RDNT tokens over 40 days. https://t.co/lCL5g91LAr— Wu Blockchain (@WuBlockchain) March 30, 2023

Realistic or not, here’s RDNT’s market cap in BTC’s terms

Initial reports revealed that RDNT will be available for yield farming for the first 40 days after its launch. Binance users will have to stake TrueUSD [TUSD] and BNB in different mining pools if they wish to earn RDNT yields.

The hype around the RDNT token may yield some accumulation, especially with access to liquidity through Binance. However, the launch may also lead to a higher circulating supply, which might curb the potential upside.

RDNT had slightly over 180.27 million tokens in circulation at press time, which represented 18% of its 1 billion RDNT maximum supply. Note that the total supply has been growing aggressively for the last four weeks.

Source: Santiment

The rising supply may explain why investor sentiment was low at press time. The weighted sentiment metric peaked on 24 March but has since dropped back to its lower range. Despite the above observations, the volume metric just reached its highest level since its launch in the last 24 hours. This was likely courtesy of the Binance listing.

Source: Santiment

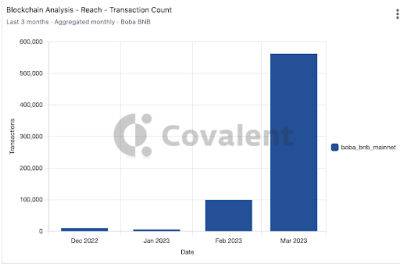

The daily active addresses also registered a spike in the last 24 hours. However, that spike was notably lower than its peak daily active address activity, whose highest level was

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com

![Unsiwap [UNI] rocked by sandwich attack, $25M stolen: Investigations show…](https://finance-news.co/storage/thumbs_400/img/2023/4/4/62777_koig5.jpg)