XRP Price Prediction as Daily Trading Volume Surges Past $1 Billion – Is Ripple Making a Comeback?

The XRP (XRP) Price has been falling back over the past two sessions, despite daily trading volumes surging above $1 billion for a third successive session.

Yahoo Finance put Wednesday’s trading volume at $1.5 billion, after clocking $1.35 billion and $1.67 billion on Tuesday and Monday.

XRP faced resistance in the $0.5650-57 area on Monday and sell pressure has been elevated ever since. The presence of the 21DMA at $0.55 likely also hasn’t helped.

The XRP price was last around $0.5320, and the bears are eyeing a potential drop back towards recent lows of $0.4250.

The XRP price’s latest reversal could have broader implications for the medium-term outlook.

That’s because it also potentially marks the rejection of an uptrend that had been in play since early 2023. XRP snapped this uptrend earlier in the month.

A rejection of the retest of this uptrend suggests a potential bearish medium-term outlook for the XRP price.

A return to $0.30 is possible in the medium term, assuming the broader crypto market’s post-Bitcoin halving consolidation continues.

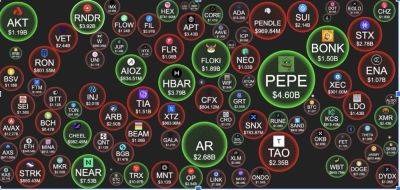

XRP has been sluggish in recent months compared to its major peers. While Bitcoin (BTC) and Ether (ETH) went up 51% and 36% in the past 90 days, XRP dropped 16% in the same timeframe.

Some potential fundamental tailwinds could soon come in to help XRP close this gap, however.

Firstly, Ripple recently announced plans to launch its own USD stablecoin. The hype surrounding this stablecoin could help pump optimism in XRP.

Secondly, the SEC vs Ripple lawsuit could soon come to a close. The SEC has asked for a $2 billion fine for the company that they claimed issued XRP as a security. That should ease concerns about XRP’s regulatory outlook in the US.

XRP’s underperformance in recent months

Read more on cryptonews.com