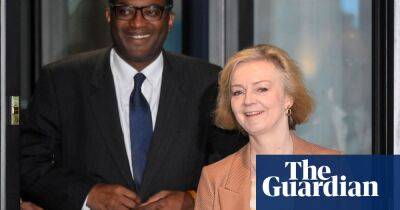

A global problem? Liz Truss’s claims on financial chaos fact-checked

After days of silence, Liz Truss has finally faced questions on the UK financial market turmoil triggered by the government’s plans for sweeping tax cuts.

The prime minister agreed to a series of interviews with local BBC radio stations on Thursday, while Chris Philp, Kwasi Kwarteng’s number two at the Treasury, also answered questions on BBC radio.

The chancellor is yet to answer questions this week, despite the Bank of England being forced to make a massive £65bn intervention in markets on Wednesday morning to prevent a liquidity squeeze on pension funds.

But some of the claims in those interviews have raised eyebrows as they insisted government measures were not to blame for the turbulence. Here we check the facts.

The claimLiz Truss said: “No, it isn’t [wrong policy] because… the majority of the package we announced on Friday was the support on energy for individuals and businesses and I think that was absolutely the right thing to do.”

The verdictIt is true the energy price guarantee was the majority of the plan announced on Friday. However, that only holds if the costs are assessed over the next two years: the total costs of permanent unfunded tax cuts would be much higher over the years. Policy decisions announced at the mini-budget will cost a net £161bn by the 2026-27 fiscal year, according to the Treasury.

But Truss’s statement is also potentially misleading in a more fundamental way: the energy support for households was first announced on 8 September, and Truss pledged “equivalent support” for businesses on the same day. Financial markets have had weeks to anticipate the costs (and many economists had come to the conclusion that borrowing to support energy bills would be cheaper than letting the economy crash).

It

Read more on theguardian.com