Berenberg Investment Firm Analyst Sees MicroStrategy as Safer Bet than Coinbase Due to SEC Risk

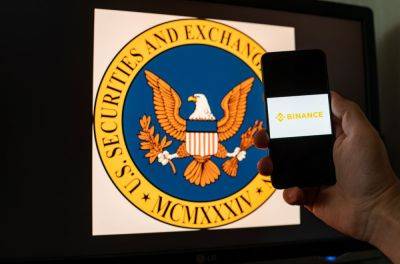

An analyst at Berenberg investment firm believes MicroStrategy is now a safer bet compared to Coinbase due to the exchange's regulatory issues.

Mark Palmer, an equity research analyst at Berenberg Capital Markets, said the US Securities and Exchange Commission will likely file an enforcement action against Coinbase as the commission increases its scrutiny of the crypto sector.

“Given the heightened uncertainty that Coinbase faces, we believe investors would be much better served investing in shares of MicroStrategy,” the analyst reportedly wrote.

Shares of MicroStrategy, a software maker better known for being the largest public holder of Bitcoin, have increased more than 90% YTD, compared to a 63% increase in Coinbase's shares over the same period.

The strong performance comes on the back of Bitcoin’s rebound in recent months. The flagship cryptocurrency has gained more than 60% YTD.

According to Palmer, MicroStrategy is an “attractive alternative” to Coinbase given the regulatory pressures on the latter.

The analyst also noted that the SEC has identified Bitcoin as a commodity while claiming that the majority of other crypto assets are securities. This makes MicroStrategy, which is a major holder of Bitcoin, an appealing choice for investors.

“The SEC has characterized bitcoin as a commodity while asserting that most (if not all) other crypto tokens are unregistered securities, putting bitcoin and MSTR in advantaged positions amidst the regulatory onslaught."

Palmer said the enforcement actions against crypto exchanges Kraken and Bittrex, as well as crypto lending platform Nexo, could be a preview of the SEC's approach to Coinbase.

“We believe investors should be focusing on whether the company would have the ability to

Read more on cryptonews.com