Breaking: Coinbase Sued by SEC Just a Day After Binance Lawsuit – Which Firm is Next?

The US Securities and Exchange Commission threw a one-two punch to cryptocurrency exchanges this week, charging yet another exchange, Coinbase, Inc., on Tuesday.

The regulator said that Coinbase was operating its platform and was not registered in the capacity of an exchange, broker or clearing agency, according to a press release.

The regulator also charged the US crypto exchange for the unregistered offer and sale of securities related to its staking-as-a-service program.

The SEC did not charge Coinbase executives in the lawsuit.

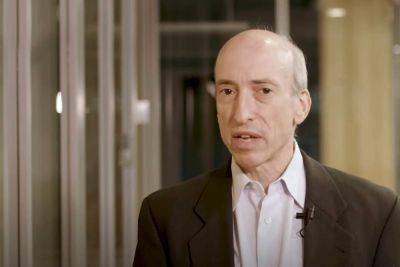

“We allege that Coinbase, despite being subject to the securities laws, commingled and unlawfully offered exchange, broker-dealer, and clearinghouse functions,” said SEC Chair Gary Gensler in a statement.

Those functions are separate in other parts of the securities markets, Gensler added.

“You simply can’t ignore the rules because you don’t like them or because you’d prefer different ones: the consequences for the investing public are far too great,” said Gurbir S. Grewal, director of the SEC’s Division of Enforcement.

"As alleged in our complaint, Coinbase was fully aware of the applicability of the federal securities laws to its business activities, but deliberately refused to follow them.”

The regulator also named 13 cryptocurrencies as securities, according to the complaint.

"Throughout the Relevant Period, Coinbase has made available for trading crypto assets that are being offered and sold as investment contracts, and thus as securities. This includes, but is not limited to, the units of each of the crypto asset securities further described below—with trading symbols SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO—(the 'Crypto Asset Securities')," the SEC said.

Som

Read more on cryptonews.com

cryptonews.com

cryptonews.com