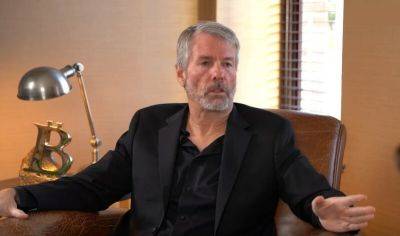

Crypto industry 'destined' to be BTC-focused due to regulators: Michael Saylor

Enforcement actions on cryptocurrency firms by regulators in the United States could result in a Bitcoin (BTC)-focused industry that will push its price over $250,000, according to MicroStrategy co-founder Michael Saylor.

In a June 13 Bloomberg interview, the Bitcoin bull explained recent enforcement actions from the Securities and Exchange Commission (SEC) will eventually play in Bitcoin’s favor — the only crypto excluded from being a security by SEC chair Gary Gensler.

Saylor added U.S. regulators "don't see a legitimate path forward for cryptocurrencies" adding "they don't have any love" for stablecoins, crypto-tokens or crypto-based derivatives.

Saylor said crypto exchanges would be the catalysts behind the significant price surge:

“The next logical step is for Bitcoin to 10x from here and then 10x again,” he claimed.

Regulatory clarity is going to drive #Bitcoin adoption by eliminating the confusion & anxiety that has been holding back institutional investors. Bitcoin dominance will continue to grow as the #Crypto industry rationalizes around $BTC and goes mainstream. pic.twitter.com/Foq4lpderj

Saylor noted Bitcoin’s market share increased from 40% to 48% in 2023 which may be attributed in part to the SEC’s enforcement activity and having now labeled 68 cryptocurrencies as securities — none of which are proof-of-work.

In the future, Saylor believes this dominance will increase to 80% as “mega institutional money” will flow into crypto after “confusion and anxiety” over crypto disappears.

Saylor and other Bitcoin-centric advocates have been met with considerable criticism, however.

Anthony Sassano, host of The Daily Gwei recently called out “Bitcoiners” that are pleased to see the SEC file lawsuits against Coinbase and other

Read more on cointelegraph.com