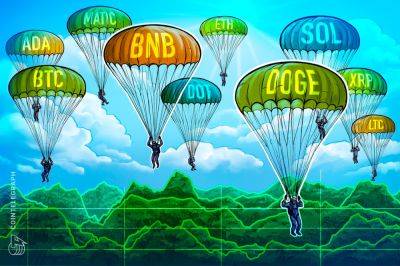

Bitcoin reaches 50% market dominance for first time in 2 years

Bitcoin (BTC) dominance, the measure of how much Bitcoin makes up of the total crypto market cap, has breached the 50% mark.

On June 19 at 6 pm UTC, Bitcoin dominance hit just above 50% and has since settled to 49.9% at the time of publication, according to data from TradingView.

This means that Bitcoin alone accounts for half of crypto’s total $1.1 trillion dollar market capitalization. Bitcoin’s current market capitalization stands at $519 billion, according to data from Coingecko.

Notably, Bitcoin’s market dominance has surged by more than 10.5% since Nov. 27, 2022, an increase driven in large part by investors looking to the flagship crypto asset as a safe haven in the wake of the FTX crisis and amid mounting regulatory scrutiny of crypto assets in the United States.

While Bitcoin dominance increased significantly over the last eight months, Ether’s (ETH) market dominance has been holding steady around the 20% mark for the better part of a year. Currently, the combined value of Bitcoin and Ether now accounts for roughly 70% of the entire crypto market.

MicroStrategy co-founder and outspoken Bitcoin bull Michael Saylor believes that Bitcoin’s market dominance will top 80% in the coming years, as increasing regulatory pressure from the Securities and Exchange Commission causes stablecoins and the majority of other crypto assets to “go away.”

Regulatory clarity is going to drive #Bitcoin adoption by eliminating the confusion & anxiety that has been holding back institutional investors. Bitcoin dominance will continue to grow as the #Crypto industry rationalizes around $BTC and goes mainstream. pic.twitter.com/Foq4lpderj

Additionally, Saylor blamed the lack of any “mega institutional money” entering the crypto space on the

Read more on cointelegraph.com