Bitcoin Price Clings to Near Term Support Despite Latest Dollar Index Surge

The US dollar experienced a substantial increase over the weekend. Since the dollar usually trades inversely proportional to Bitcoin, analysts predicted that the Bitcoin price should have declined over the weekend. However, Bitcoin appears to be holding steady.

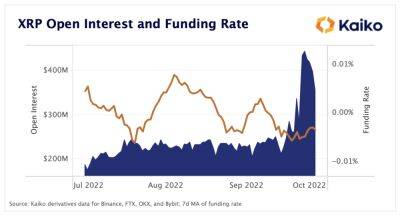

Crypto researcher and analyst Lark Davis tweeted earlier today that the US Dollar Index (DXY) has now crossed the 114.5 points, reversing the relative strength index (RSI) decline.

The spike in the dollar's value coincides with a drop in several other currencies. The British Pound dropped to $1.03 - its lowest point against the greenback - earlier this week.

Several analysts, perceiving the current trend, have sought to capitalize. A tweet from analyst Crypto Rover on Sunday forecasted a significant decline in Bitcoin, and several comments encouraged traders to open short positions, as the leading cryptocurrency could easily experience a significant decline.

However, Bitcoin's ability to serve as a hedge against inflation is typically cited as one of the many advantages of cryptocurrencies by its enthusiasts. The argument is that Bitcoin allows investors to earn profits even when fiat currencies, particularly the US dollar, struggle. An increase in dollar performance would also have an impact on the leading cryptocurrency.

Regardless of the forecast and speculations, Bitcoin remains stable. The asset currently trades at $19,203, marking a 2.03% 24-hour uptrend.

Bitcoin’s low point also remains at $18,535, which it hit on September 23.

The bear market has encouraged many investors to think long-term and position themselves to enjoy gains down the line.

Glassnode, one of the crypto market’s leading data analytics providers, recently shared that its CoinDays Destroyed

Read more on cryptonews.com