Bitcoin price due 'big dump' after passing $20K, warns trader

Bitcoin (BTC) returned to intraday resistance on Sep. 30 as analysis predicted that $20,000 could break before a new comedown.

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it circled $19,600 at the time of writing.

The pair had seen a bout of more volatile behavior the day prior, briefly losing $19,000 before bid support took the market higher.

The day looked to be an important one for bulls, with the monthly close combining with European Consumer Price Index (CPI) data.

Geopolitical events involving Russia’s official annexation of Ukrainian territory and associated implications were also on traders’ radar. Russian president Vladimir Putin was expected to speak at a ceremony during which he would formally ratify four Ukrainian regions joining Russia.

“Today is the day,” Il Capo of Crypto declared, referencing Bitcoin’s next squeeze higher which should turn to losses thereafter.

He continued that the price action would likely take the form of a “pump to 20000-20500 before Putin's speech. Then big dump.”

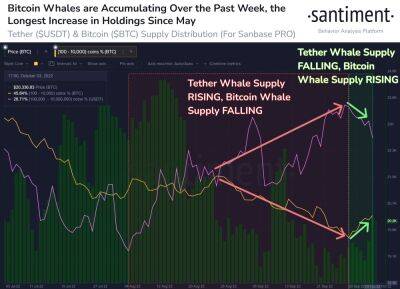

In a potentially more optimistic take, market analysis outfit IncomeSharks argued that bears had recently become less confident shorting BTC.

“Bitcoin selling pressure has slowed a lot,” it told Twitter followers on Sep. 29.

On the day, meanwhile, IncomeSharks noted that United States equities futures were gathering upside momentum, allowing for price relief across correlated crypto markets.

“$SPX futures pushing up. Markets have flip flopped almost every other day this week. Bulls holding support with strength,” it summarized.

In Europe, the picture was less enticing, as CPI readings for Eurozone member states made for eye-watering reading.

Related: Bitcoin 'great detox' could trigger a BTC price drop to

Read more on cointelegraph.com