Bitcoin Price Prediction as Analyst Says US Recession Can Be Avoided – Can BTC Reach $100,000?

Recent price action in Bitcoin showcases the asset's volatility and susceptibility to market rumors. Earlier on Monday, Bitcoin surged from just under $28,000 to $30,000 in a matter of minutes.

This rapid climb was attributed to unconfirmed whispers on social media platforms that the US SEC had greenlit BlackRock’s iShares spot Bitcoin ETF application.

Cointelegraph was among the first to spread the word but hastily retracted its statements, underscoring the fragility of information in the crypto space.

For more details, see our coverage: Bitcoin Price Pumps From $28,000 to $30,000

Contrary to prevailing market sentiments, the Canadian Imperial Bank of Commerce (CIBC) holds an optimistic outlook on the US economy.

Where most anticipate Federal Reserve passivity:

Highlights from CIBC's upcoming report:

On future rate decisions:

Coming up next:

CIBC's optimistic stance on US economic growth and potential rate hikes could bolster BTC as investors seek hedging alternatives. Such economic shifts, paired with monetary policy adjustments, often drive cryptocurrency market sentiment and price dynamics.

On October 16, Bitcoin (BTC) traded for $28,119, marking an impressive surge of nearly 4.5% in the past 24 hours. This upward movement is supported by a substantial 24-hour trading volume of $24.57 billion.

Bitcoin remains the uncontested leader in the broader cryptocurrency landscape, clinching the top spot with a robust market cap of $548.76 billion. Currently, the circulating supply of Bitcoin is 19.52 million, with its maximum limit set at 21 million BTC.

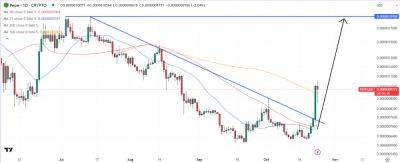

From a 4-hour chart view, Bitcoin's pivot point is $27,690. On the upside, immediate resistance is observed at $28,465, followed by subsequent levels at $29,235 and $29,920.

C

Read more on cryptonews.com