Bitcoin Price Prediction: BTC Drops by Almost 2.50% - Key Insights for Today

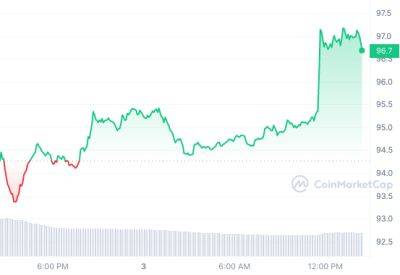

In a swift turn of events, Bitcoin's value dipped nearly 2.50% in today's cryptocurrency market, causing a significant stir among investors and stakeholders.

This unexpected drop in Bitcoin's price is the latest in a series of fluctuations that have been characteristic of this digital currency.

This Bitcoin price prediction provides crucial insights into the current trends and indicators in the Bitcoin market that could guide potential investors and current holders in making informed decisions.

With a comprehensive analysis of the factors influencing this decline, we seek to forecast potential trajectories that Bitcoin's price could take in the near future.

In comparison to the Australian dollar, the price of BTC has plummeted by a staggering 21% on the Australian branch of the Binance cryptocurrency market.

Hosam Mahmoud, a Research Analyst at CCData, conveyed to CoinDesk in an interview, "The announcement from Binance provoked traders to offload their BTC/AUD pairs, causing the price to hit a historically significant discount."

On May 18, Binance initially informed its customers that it would suspend services involving the Australian dollar (A$) due to a decision made by the third-party payments provider, PayID.

Immediate cessation of bank transfer deposits was enforced, although PayID withdrawals were permitted until June 1 at 5 p.m. local time.

Furthermore, the exchange notified its Australian customers that any remaining AUD in their accounts as of May 31 would be promptly converted into USDT.

In the aftermath of these announcements, there has been a persistent rush to withdraw funds, significantly influencing the depreciation of Bitcoin's (BTC) price on Binance Australia.

Binance has indicated that it is actively seeking

Read more on cryptonews.com