Crypto Lender Ledn Sets New Record with $1.6B in Loans Year-to-Date

Shalini is a crypto reporter who provides in-depth reports on daily developments and regulatory shifts in the cryptocurrency sector.

Crypto lending platform Ledn on Monday said it processed $1.67b in loans so far this year as of Q3 2024. This split is divided between $258.7m for individual retail users and $1.41b for institutional clients.

Specifically in Q3 2024, Ledn managed loan transactions amounting to over $506m. The retail sector saw significant growth this month, with loans increasing 225% year-over-year, primarily due to Ledn’s Celsius refinancing program, the introduction of crypto ETFs and reduced market volatility, it said.

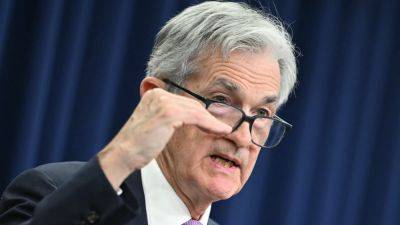

Institutional loans, which accounted for the majority of Ledn’s loan volume, grew to $437.7m in Q3. This rise reflects a broader trend of institutions seeking digital asset-backed financing amid tight monetary policies.

Ledn offers services including Bitcoin-backed loans, Ether-backed loans, and B2X loans. It also introduced a third-party proof-of-reserves standard, enhancing transparency in its operations.

In the first quarter, Ledn said it facilitated over $690m in loans, with a split of $584m going to institutional clients and $106m to retail investors.

Major market participants are seeking alternative financing options amid restrictive monetary policies and intense competition for dollar funding. Total loan originations since Ledn’s inception in 2018 have exceeded $6.5b across retail and institutional markets, it said.

Recent market events, such as the Bitcoin halving and the rise of Ethereum ETFs in Asia, have contributed to the increased demand for Ledn’s services. Investors are increasingly taking out Bitcoin and Ethereum-backed loans to capitalize on new investment opportunities.

John

Read more on cryptonews.com