Crypto price today: Bitcoin holds above $19K; Ethereum, Ripple gain up to 30%

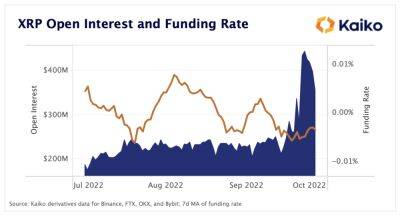

Ethereum (ETH), the second most-valued crypto after Bitcoin, also was up 7% at $1352, while Ripple (XRP) gained by a whopping 30% to $0.536. The US-dollar pegged stablecoin Tether (USDT) traded with a mild cut, while meme-coins, including Dogecoin and Shiba Inu also rose in trade by up to 8%. Bitcoin (BTC) was largely holding on to $19,000 levels even as central banks globally have resorted to aggressive interest rate hikes following the US Fed’s ultra-hawkish outcome on Wednesday. After the Fed outcome, Bitcoin tumbled to below $18,400, its lowest level since early June, but later re-gained momentum in Thursday’s session after investors started to take positions again in the crypto market. Following sharp gains in digital tokens, the global market cap over the last 24 hours ascended by 5% to $953.18 billion, while volumes in the crypto universe tanked by over 16 per cent.

Did you Know?

Jobs in crypto, blockchain, and NFTs have grown by 804% in India between April 2020 and April 2022 according to a report by Indeed

View Details »The central banks of the eurozone, Switzerland and Canada have also recently taken on aggressive monetary tightening measures. So, largely as this restrictive monetary policy tends to negatively impact economic output, riskier assets including cryptocurrencies will be weighed down.

Read more on economictimes.indiatimes.com economictimes.indiatimes.com

economictimes.indiatimes.com![VeCahin’s [VET] Q2 report findings can help you in your Q4 trades](https://finance-news.co/storage/thumbs_400/img/2022/10/2/43283_5blxe.jpg)