Fed Paper Advocates Taxation or Prohibition of Bitcoin to Address Government Deficits

Ruholamin Haqshanas is a contributing crypto writer for CryptoNews. He is a crypto and finance journalist with over four years of experience. Ruholamin has been featured in several high-profile crypto...

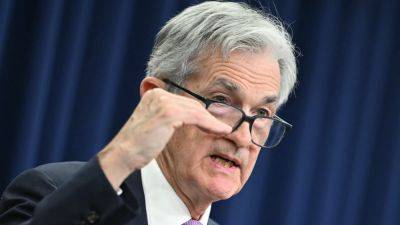

A new research paper from the Federal Reserve Bank of Minneapolis has raised concerns about Bitcoin’s impact on government fiscal policies, suggesting that the cryptocurrency may need to be taxed or banned to help governments manage deficits.

The paper, released on October 17, argues that Bitcoin complicates efforts to maintain permanent government deficits, especially in an economy reliant on nominal debt.

According to the Minneapolis Fed, Bitcoin creates what it calls a “balanced budget trap,” which forces governments to balance their budgets.

Bitcoin, with its fixed supply and lack of direct claims on real resources, disrupts traditional fiscal policy by providing an alternative financial asset.

The researchers proposed that either a tax on Bitcoin or an outright legal prohibition would be necessary to counter this effect.

“A legal prohibition against Bitcoin can restore the unique implementation of permanent primary deficits, and so can a tax on Bitcoin,” the paper stated.

A primary deficit occurs when a government’s expenditures exceed its revenue, excluding interest payments on existing debt.

The key distinction made in the paper is the idea of a “permanent” primary deficit, where governments plan to continue outspending indefinitely.

The U.S. national debt has now reached $35.7 trillion, with the primary deficit currently standing at $1.8 trillion.

A significant portion of this deficit has been driven by increased interest costs on Treasury debt, which jumped 29% to $1.13 trillion this year due to rising interest rates and

Read more on cryptonews.com