'I have no money': Thousands of Americans see their savings vanish in Synapse fintech crisis

For 15 years, former Texas schoolteacher Kayla Morris put every dollar she could save into a home for her growing family.

When she and her husband sold the house last year, they stowed away the proceeds, $282,153.87, in what they thought of as a safe place — an account at the savings startup Yotta held at a real bank.

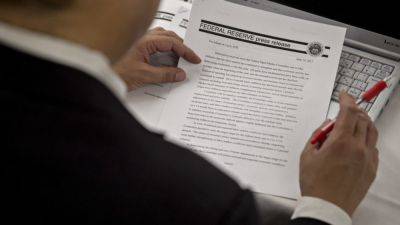

Morris, like thousands of other customers, was snared in the collapse of a behind-the-scenes fintech firm called Synapse and has been locked out of her account for six months as of November. She held out hope that her money was still secure. Then she learned how much Evolve Bank & Trust, the lender where her funds were supposed to be held, was prepared to return to her.

«We were informed last Monday that Evolve was only going to pay us $500 out of that $280,000,» Morris said during a court hearing last week, her voice wavering. «It's just devastating.»

The crisis started in May when a dispute between Synapse and Evolve Bank over customer balances boiled over and the fintech middleman turned off access to a key system used to process transactions. Synapse helped fintech startups like Yotta and Juno, which are not banks, offer checking accounts and debit cards by hooking them up with small lenders like Evolve.

In the immediate aftermath of Synapse's bankruptcy, which happened after an exodus of its fintech clients, a court-appointed trustee found that up to $96 million of customer funds was missing.

The mystery of where those funds are hasn't been solved, despite six months of court-mediated efforts between the four banks involved. That's mostly because the estate of Andreessen Horowitz-backed Synapse doesn't have the money to hire an outside firm to perform a full reconciliation of its ledgers, according to

Read more on cnbc.com

cnbc.com

cnbc.com