“MiCA Regulation is Far From Complete” — Tom Kiddle, Ex-Ripple and Apple

Hassan, a Cryptonews.com journalist with 6+ years of experience in Web3 journalism, brings deep knowledge across Crypto, Web3 Gaming, NFTs, and Play-to-Earn sectors. His work has appeared in...

How can crypto be without regulators? That is a question a lot of crypto enthusiasts would want an answer to. Is MiCA in our favor? Probably.

But here is the reality: regulatory clarity has become one of the most sought-after elements for businesses looking to establish a strong foothold in the market.

With numerous regulatory frameworks in place around the world, the European Union’s Markets in Crypto Assets (MiCA) regulation stands out as a leading example.

It is renowned for providing businesses with much-needed transparency and guidelines, MiCA proudly represents the EU’s ambition to become a global leader in the crypto space.

Last week, Tom Kiddle, the co-founder of Palisade, a digital asset custodian backed by Ripple, shared some of his insights from the Digital Commonwealth’s Mansion House Summit with Cryptonews.

His views spanned the challenges and opportunities presented by MiCA and how the changing global political landscape is reshaping crypto regulation.

Having worked across notable companies like Ripple, Apple, and BT, Kiddle’s understanding of regulatory frameworks, consumer protection, and governance gives him a unique perspective on the hurdles still facing the crypto sector.

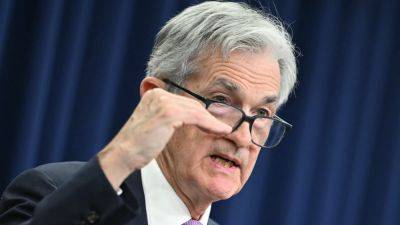

While MiCA is being hailed for the clarity it brings to the market, Kiddle raised important concerns.

From the question of whether MiCA offers sufficient protection for retail investors, to the gap in regulation for NFTs and decentralized finance (DeFi), Kiddle believes the regulation is a significant first step but far from comprehensive.

With

Read more on cryptonews.com