Premier Inn owner surpasses pre-Covid profits as travellers seek deals

The owner of Premier Inn has said profits have surpassed pre-pandemic levels as the UK’s biggest budget hotel chain benefits from a surge in demand from cost-conscious holidaymakers.

Whitbread, which runs almost 900 hotels in the UK and Germany as well as restaurant chains including Beefeater, Bar & Block and Brewers Fayre, said it would benefit from the scale of its business as small operators succumb to a combination of labour shortages and cost inflation.

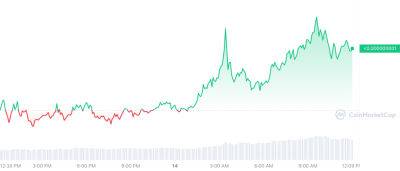

The company beat analysts’ expectations, reporting £375m in pretax profits for the year to 3 March, up from £58m in 2022 and 34% more than the year ending February 2020.

Investors cheered the results, which were driven by a 544% increase in adjusted annual profits at Premier Inn UK, sending Whitbread’s share price up 5% and making the company the biggest riser in the FTSE 100.

“The recovery in market demand in conjunction with a structural decline in the independent sector has provided a helpful backdrop,” said the Whitbread chief executive, Dominic Paul, who took over from Alison Brittain last month. “We believe that operational challenges created by labour shortages and cost inflation may put further pressures on the independent sector, creating structural growth opportunities for Premier Inn across the UK. The budget branded hotel sector has consistently delivered attractive rates of room growth and has also proven its resilience during economic downturns, as guests trade down to lower cost alternatives.”

Whitbread, which also announced a £300m share buyback and raised its final dividend, said that demand continues to be strong; UK sales were up 17% year on year in the first seven weeks of the company’s new financial year.

Premier Inn UK reported a 50% increase in total

Read more on theguardian.com