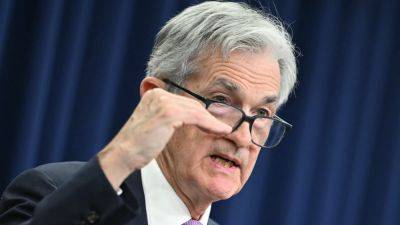

Traditional Finance Eyes Tokenization, But BIS Warns of Risks – Report

Veronika Rinecker is based in Germany, studied international journalism and media management. She specializes in politics and regulation, energy, blockchain, and fintech. Since 2017, she has been...

The Bank for International Settlements (BIS) released a report on October 21 highlighting both the potential and the pitfalls of tokenization in traditional finance.

While tokenization offers benefits like faster and cheaper transactions, BIS warns in its report of potential risks to governance, legal frameworks, and financial stability.

According to the BIS, tokenization can be seen as a natural evolution in market structures. Token arrangements, which provide platform-based intermediation for financial transactions, can lead to changes in market structure. This can result in reduced transaction costs, increased efficiency, and broader market access.

The BIS also noted that tokenization offers opportunities for improved safety and efficiency in pre- and post-trade functions. For example, using PvP and DvP settlement can reduce principal risks, while programmability and automation can streamline processes.

While the BIS acknowledges the potential benefits of tokenization, it also emphasizes the associated costs and risks. Investment costs are likely to be higher for initiatives with greater expected benefits. Additionally, the regulatory framework is still evolving, and network effects may take time to materialize.

According to the BIS, token arrangements face risks similar to traditional market infrastructures regarding governance, legal, credit, liquidity, and operational risks. However, these risks may manifest differently due to tokenization’s unique characteristics.

The BIS believes that tokenization may affect central banks’

Read more on cryptonews.com