Yearn Finance advocates for the adoption of ERC-4626 tokenized vault standard

Following the successful deployment of twenty-five previous Ethereum Request for Comments (ERC) standards, including the industry-recognized ERC-20 designed for tokens, ERC-721 for nonfungible tokens (NFTs), and the single smart contract multi-token ERC-1155; the newly-passed ERC-4626 is gaining traction within the Ethereum community for its purported yield-bearing benefits.

Referred to as the “tokenized vault standard,” ERC-4626 is set to be implemented at the next Ethereum fork upgrade following approval by the developers within Ethereum’s governance procedure.

Serving as an addition to ERC-20 — and considering the utilization of under-review EIP-2612 for the approval shares user experience (UX) — the ERC-4626 standard is expected to enact wide-scale benefits across Ethereum’s decentralized finance (DeFi) ecosystem, enhancing the composability and accessibility of yield-bearing vaults across multiple networks.

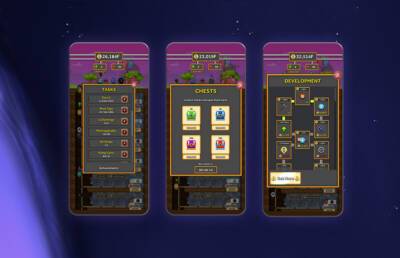

As an application programming interface (API), much of the implementation will occur behind the scenes within the network's operation, and therefore will not be particularly visible on the user-end dashboard, but will be immensely valuable for their participating experience.

One of the primary attractions to interacting with DeFi protocols for the retail market is their positively disproportionate yield generation in comparison to traditional banking bond accounts and savings offerings.

Yield-bearing assets such as SushiSwap’s xSushi, Aave’s aToken, or Yearn Finance’s yToken, enable users to stake the network's native tokens for a wrapped version, benefiting from both the acquired liquidity and interest earned.

However, as Yearn Finance succinctly points out, “to build a single app on top of DeFi's yield-bearing

Read more on cointelegraph.com