Bitcoin Price Prediction as BTC Holds Steady at $26,500 Support – Are Bears Taking Control?

Key Points

Bitcoin, the world's premier cryptocurrency, faced challenges in sustaining its value, plunging below the $27,000 threshold on Friday. In the last 24 hours, its price largely oscillated around the $26,600 mark.

The recent depreciation is largely tied to the unveiling of the US Consumer Price Index (CPI) for September. This index rose by 0.4%, surpassing the projected 0.3%.

This unexpected surge in the CPI catalyzed a sell-off in risk-prone assets, encapsulating cryptocurrencies.

Concurrently, the US Dollar rallied by 0.8% after the US CPI release, marking another significant element pressuring the cryptocurrency realm downwards.

This scenario underscores a heightened investor prudence, a sentiment casting shadows not merely on the crypto space but also on the conventional financial arenas.

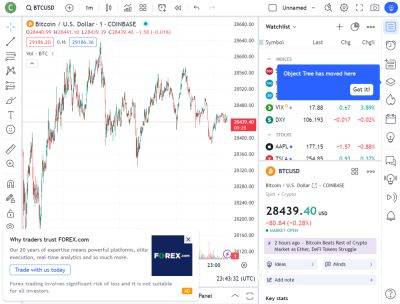

On October 13, Bitcoin's current trading price stands at $26,730, reflecting a marginal gain of 0.10% over the last 24 hours.

With a significant 24-hour trading volume of $13.54 billion, Bitcoin confidently holds its dominant position as the #1 cryptocurrency on CoinMarketCap. The live market capitalization for Bitcoin is an impressive $521.58 billion.

As of now, approximately 19.51 million BTC coins are in circulation, inching closer to its predetermined cap of 21 million BTC.

In terms of the 4-hour chart, the pivot point for Bitcoin (BTCUSD) is identified at $26,536. On the upside, Bitcoin confronts its first line of resistance at $28,000, followed by resistances at $29,062 and $30,574.

On the downside, support is placed firmly at $25,426, with further supports at $23,891 and $22,876, respectively.

Two significant technical indicators provide insights into the current market trend. The Relative Strength Index (RSI) is marked

Read more on cryptonews.com