Bitcoin Price Prediction as US Core Inflation Data is Announced – Is a Bullish Reversal Imminent?

In light of the recent US core inflation data, the crypto community is eagerly discussing the potential trajectory of Bitcoin (BTC/USD) for October 12.

As recent US inflation data outstrips forecasts, the financial realm is abuzz with speculation and predictions.

Particularly in the cryptocurrency sector, eyes are keenly fixed on Bitcoin, gauging its potential response.

September's inflation was notably higher than anticipated, kindling discussions about the Federal Reserve possibly hiking interest rates, especially with preceding robust jobs market data.

According to the Bureau of Labor Statistics, the consumer price index witnessed a steady year-on-year rise of 3.7%.

Even though analysts had projected a minor downturn, the rate remained consistent with the previous month.

Monthly inflation saw a slowdown from 0.6% to 0.4%. A silver lining appeared in the form of stable "core" inflation rates, maintaining a steady pace of 0.3% month on month, despite excluding erratic energy and food prices.

On an annual scale, core inflation slightly decreased from 4.3% to 4.1%. As these economic waves ripple, is Bitcoin poised for a bullish reversal? The stage is set for intriguing market dynamics.

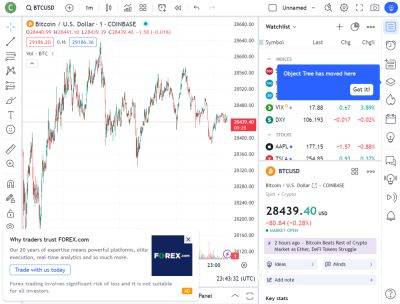

With a circulating supply nearing its max of 21 million BTC coins, the 4-hour chart points to key figures: a pivot point at $27,000, resistances at $27,210, $27,717, and $28,198, and supports at $26,586, $26,023, and $25,475.

Technically, the RSI is at 30, indicating bearish sentiment, while the MACD values are awaited for further momentum insight. Notably, the price hovers just above the 50 EMA of $26,950.

Chart patterns reveal a symmetrical triangle breakout around $27,700, emphasizing a potential bullish momentum.

Fundamentally, the unchanged

Read more on cryptonews.com