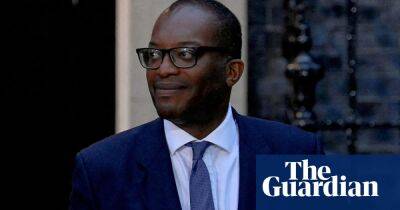

Kwasi Kwarteng could borrow for the right reasons. These are the wrong ones

The billions of pounds of extra borrowing signalled by Kwasi Kwarteng in his not-so-mini budget can be justified as long as the money isn’t flushed down the toilet.

Funds for renewable energy projects or to boost skills training would generate a return over the next decade.

Kwarteng’s extra borrowing, on the other hand, will be donated to the better-off in society via the most generous tax-cutting budget since 1972, increasing inequality in a way not seen since the early 1980s and without any evidence such largesse will boost economic growth by even the same amount.

In a startling turnaround from the austerity promised by Rishi Sunak’s Treasury, Kwarteng says he will need to borrow an extra £72bn before next April and more than £250bn above previous forecasts over the next five years to fund his latest tax cuts and the energy price cap announced a fortnight ago.

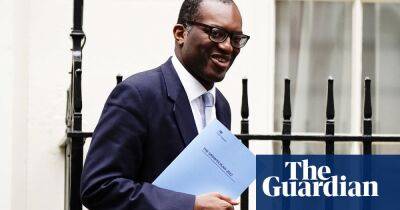

Scrapping the higher 45p rate of tax will cost the government about £2bn a year, and that is cash the Treasury will never see again.

There is little chance it will attract the world’s high-flyers to Britain’s shores. The only evidence we have from a cut in the higher rate from 50p in 2012 was its effect on high-earning bankers, City lawyers and university bosses, who found they suddenly had the cash to spend on a second or third home.

There might be a small return to the exchequer from extra house buying, except that Kwarteng also increased the tax thresholds on stamp duty. He said the intention was to support first-time buyers in every region … yet the figures clearly show that most of the activity that will benefit is in London and the south-east.

Kwarteng’s reversal of this year’s national insurance rise and a 1p cut in the basic rate of income tax is a reward for

Read more on theguardian.com