Rebuke from IMF is a global embarrassment for Truss and Kwarteng

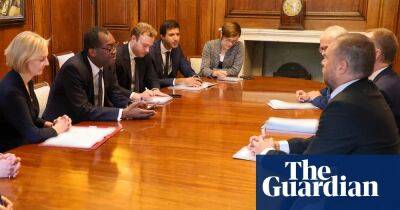

Liz Truss and Kwasi Kwarteng have taken on the economic orthodoxy. They have announced extra borrowing to pay for tax cuts. They have sacked the Treasury’s top mandarin. They have insisted they will press on with their dash for growth despite a hostile reaction in the markets.

Now the economic orthodoxy has struck back – and in the most high-profile way possible: a public and stinging rebuke from the International Monetary Fund (IMF).

It is hard to overstate just how severe an embarrassment the dressing down from the IMF is for the government, which has been told to rethink last week’s mini-budget. The blunt language used by the IMF spokesperson was the sort normally reserved for a struggling emerging market economy seeking financial support.

The UK is not in that position. There is no immediate prospect of Kwarteng needing a bailout but the IMF’s intervention highlights just how quickly the chancellor’s strategy has unravelled. It also illustrates the IMF’s concern that a full-on financial crisis in the UK could have ripple effects through an already vulnerable global economy.

The IMF has two main concerns. First, it is worried that what the Treasury is doing with tax and spending (fiscal policy) is at odds with what the Bank of England is doing with interest rates (monetary policy).

Second, it is opposed to the blanket support the government is providing for energy bills, and would prefer more support to be going to the neediest.

“Given elevated inflation pressures in many countries, including the UK, we do not recommend large and untargeted fiscal packages at this juncture, as it is important that fiscal policy does not work at cross purposes to monetary policy,” it said.

Kwarteng has announced that he will make another big

Read more on theguardian.com