Mark Carney accuses Truss government of undermining Bank of England

The former governor of the Bank of England Mark Carney has accused Liz Truss’ government of “undercutting” the country’s economic institutions and working at “cross purposes” with Threadneedle Street.

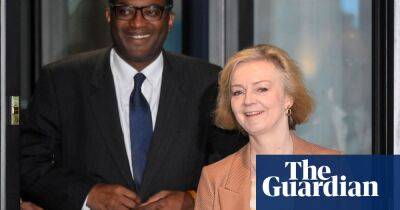

Carney’s comments come after the Bank was forced to step in with a £65bn emergency bond-buying programme on Wednesday as part of efforts to quell a market meltdown, which risked draining pension funds of cash and leaving them at risk of insolvency. Sweeping tax cuts announced by the chancellor, Kwasi Kwarteng, last week have triggered investor panic over the future health of the UK economy, prompting a sharp fall in the value of the pound and driving government borrowing costs higher.

Carney said: “Unfortunately having a partial budget, in these circumstances – tough global economy, tough financial market position, working at cross-purposes with the Bank – has led to quite dramatic moves in financial markets.”

The Bank’s massive intervention on Wednesday prompted comparisons to 1992’s Black Wednesday, when the UK was ejected from the European exchange rate mechanism for failing to keep its exchange rate above its lower limits.

However, the intervention appeared to have made some impact in calming the market turmoil, though the pound was still down around 1.1% against the dollar at $1.07 on Thursday morning.

Carney, who made the comments in an interview with BBC Radio 4’s Today programme, led the Bank of England for seven years until March 2020.

Read more on theguardian.com