UK: Fears that market turmoil over Truss tax cut plan could hit Europe's economy

Fears have been expressed that the market turmoil in response to the new British government's financial plan could further weaken Europe's economy.

The pound tumbled further later on Monday despite efforts by Britain's finance ministry and the Bank of England to reassure financial markets. Earlier it had rallied after falling to a record low against the US dollar overnight.

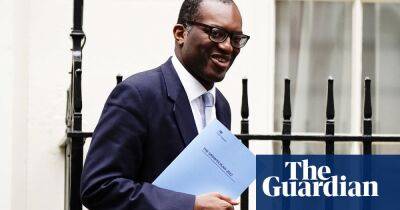

Traders are shying away from the British currency after the Chancellor (finance minister) Kwasi Kwarteng announced on Friday a big tax-cutting plan designed to grow the economy — funded by huge increases in government borrowing — raising fears that inflation, currently at 9.9%, could spiral further.

The cost of borrowing for the UK rose sharply on Monday, with yields on the UK's five-year bonds soaring to a higher level than those in Greece and Italy. That implies that markets see more risk in the UK's medium-term debt than those of the eurozone's most indebted members.

In a move to reassure markets, the UK Treasury said Kwarteng would set out a medium-term fiscal plan on November 23, alongside official growth and borrowing forecasts.

Earlier, the Bank of England said it would not hesitate to change interest rates to curb inflation and was monitoring markets "very closely", after the pound earlier went into a tailspin.

But it only promised to act "at its next meeting" on November 3, quashing rumours of an emergency BoE meeting that had helped the pound to rally temporarily. In response, the UK currency immediately fell again to under $1.07 (€1.11) 18:00 CET, approaching its all-time low of just above $1.03 (€1.07) reached early on Monday.

A top official at the US central bank said the UK's fiscal plan increased economic uncertainty and could have a

Read more on euronews.com

euronews.com

euronews.com